Evolution of cryptocurrency: from the room to the management of digital assets

Over the past decade, cryptocurrency has undergone a significant transformation of its humble beginnings as digital currency into a full-fledged digital asset management system. From an innovative experience in decentralized finance (DEFI) to a largely acceptable and regulated financial instrument, bitcoin and other cryptocurrencies have developed considerably in their trip.

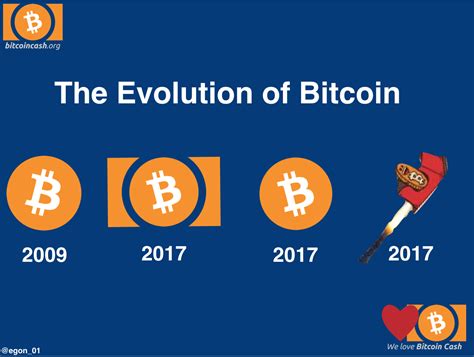

Bitcoin Birth

In 2009, an anonymous individual or a group of people using a pseudonym Satoshi Nakamoto created Bitcoin as a peer-to-peer electronic silver system. This innovative approach to digital currency has challenged traditional fiduciary currency, providing a decentralized, secure and transparent means of exchange. The first blockchain Bitcoin blockchain, known as Block Genesis, was obtained on January 3, 2009.

The first years (year 2010-2014)

While more and more developers have started to contribute to Bitcoin software, the project infrastructure has expanded and that new functions have been introduced. Remarkable development was the creation of a decentralized exchange (DEX) in 2011, which allowed users to market cryptocurrency in an open network.

Other major cryptocurrencies, such as Litecoin (LTC), Ethereum (ETH) and Monero (XMR), also performed in the first years. These alternative projects have contributed to the growth of the cryptocurrency ecosystem by providing new uses, payment systems and decentralized applications (DAPP).

Legislative verification

While the value of bitcoin and other cryptocurrencies were starting to grow, administrations around the world began to notice. In June 2013, the Chinese government prohibited trade with most foreign currencies, including those issued by central banks to try to limit speculation.

In response, governments around the world have implemented more strict rules on cryptocurrency transactions, including an exchange requirement to register for the authorities and follow the directives of legalization prevention (LMA). This movement marked a significant transition from the most acceptable approach used in the first days of Bitcoin.

Decentralized financial growth (DEFI)

In 2016, DEFI became a different category of cryptocurrency, focusing on loan, loan and trading platforms using intelligent contracts and decentralized applications. The first DEFI protocol, Makerdao, was launched in 2017.

The use of Makedao allowed users to deposit funds on the DAO network (decentralized autonomous organization), which then divided them into various projects using the marker system. This innovative experience has shown the potential of blockchain technology to facilitate loans and risk management on a decentralized scale.

Current condition of cryptocurrency

Nowadays, Bitcoin and other cryptocurrencies have become more and more widespread, and many institutional investors and financial institutions include their use. The emergence of new asset classes, such as Stableoins, has further expanded the possible applications of the cryptocurrency market.

New blockchain networks are developed to improve scalability, security and conviviality in various cases, such as Polkad (DOT) and Solana (soil). In addition, the DEFI platform, including UNISWAP (UNI) and AAVE (AAVE), has easier for individuals to participate in decentralized financial markets.

Management of digital assets: next limit

While cryptocurrency continues to develop, its possible applications only exceed speculation or investment objectives. Digital asset management (DAM) is presented as a different category that uses cryptocurrency forces to provide transparent, safe and effective financial services.

Добавить комментарий