Power of Sentiment: As a market psychology leads the Classic Prize award

In a rapidly evolving world of cryptocurrency, one asset stands out for its ability to resist traditional market expectations. Ethereum Classic (etc), a hard fork of the original blockchain Ethereum, has managed to maintain a unique market position, despite being one of the largest and most valuable coins in the world. But what leads to its price? Is it because of the basic value, technical analysis or something more complex?

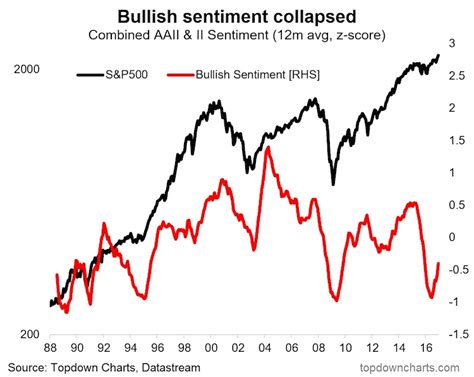

Market Sentiment: Key driver

Market sentiment is a collective sense of future asset performance among investors. In markets with cryptomes, sentiment can be affected by a wide range of factors, including messages, events, social media sounds and even the general mood of traders. For etc. The market sentiment plays an essential role in determining its price.

There are several key elements that contribute to sentiment around etc::

- Liquidity : etc. It is one of the hottest coins on the market, with high volumes of trading and a strong book book. This liquidity helps stabilize prices and attracts more investors.

- Basic value : Although the ETC basic value may not be as high as some other coins, many investors highly recognize its basic technology and a hard fork mechanism. The fact that it is a heavy fork of the original blockchain Ethereum blockchain gives it a unique advantage on the market.

3 This sound helps to create excitement and attract new investors.

Technical Analysis: Analytics View

While sentiment is a decisive factor, technical analysis plays an important role in determining the direction of the ETC price. Technical analysts use different charts and indicators to identify trends, levels of support and resistance zones that can help guide their business decisions.

Some key technical aspects that affect price, etc. Between:

1.

- Resistance zones : There are several resistance zones, including the upper limit of its current range ($ 45-55) and the previous maximum ($ 40).

- Trends lines

: ETC have been watching DowntRend since June 2021, with various trend lines and channels indicating potential reversal.

Movement of prices: result

As for predicting price movements, market sentiment can be a blessing and a curse. On the one hand, investors who hold their positions can record significant profits due to the liquidity of assets and strong levels of support. On the other hand, investors who sell can see that their assets will lose value because the price will fall below the key resistance zones.

In the last months, etc. It experienced some volatility, with its price fluctuating between $ 35 and $ 50. Nevertheless, property remains one of the most valuable coins in the world with a market capitalization of more than $ 10 billion.

Conclusion: Power of Sentiment

Sentiment around Ethereum Classic plays an important role in determining its price. Market psychology can affect the basic value, technical analysis and sounds of social media to varying degrees. While the basic ETC technology is highly recognized by many investors, the liquidity of assets, the presence of social media and prices fluctuations ultimately form its direction.

When the crypto -market market is constantly evolving, it will be interesting to see how sentiment affects the price, etc. In the future. Will investors continue to maintain their positions or sell when the price increases? Only time will show, but one thing is sure – the power of sentiment plays a decisive role in shaping the direction of this unique cryptocurrency.

Добавить комментарий