Bitcoin SV (BSV) Price Operational Strategy Research

In the world of cryptocurrency, prices are an important aspect that investors and traders need to understand to make conscious decisions. Bitcoin SV (BSV), an alternative to Bitcoin blockchain, has gained traction in recent years due to increasing scalability and security. In this article, we will go into the BSV pricing strategy in the world, studying how traders can use technical analysis to identify trends and make cost -effective transactions.

What is price activity?

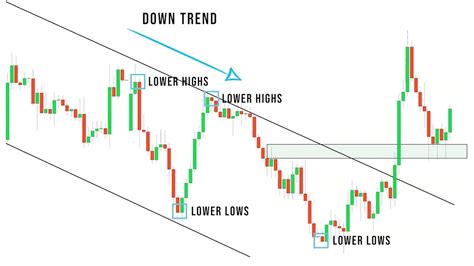

Price activity refers to the actual movement of currency prices over time. This is the basic aspect of the cryptocurrency trade, as it gives traders a valuable insight into the mood and behavior of the market. Price action means monitoring of coin price fluctuations, models, trends and other signals that may indicate possible buying or selling options.

Bitcoin SV (BSV) Technical Analysis

In order to study BSV price operating strategies, we need to understand its technical characteristics. Here are some key points:

* Price range : BSV current price range is from $ 150 to $ 250, indicating a relatively narrow trading range.

* Trend : 50 -period variable average (MA) shows the bullish trend, while the relative strength index (RSI) measures the market pulse and suggests that BSV has already created a strong upward degree.

* Support and Resistance Levels : BSV price currently supports $ 175 and the resistance level is $ 200-250.

BSV price operating strategies

Now that we have looked at BSV’s technical features, let’s explore some popular price operating strategies:

1

The trend as the following : As mentioned above, 50 periods of MA and RSI provide convincing evidence of the bullish trend. When the price exceeds the MA, it is likely to continue up with a trend in viable strategy.

- Range Trade : BSV narrow trading range makes it an ideal candidate for the range for trading. Traders can buy when the price drops below $ 150 and sells when it breaks down above $ 250.

3

Average Reverse

: 50 -period MA and RSI show that BSV has already developed a strong upward degree, making the average reverse of a viable strategy. When the price moves back to the lower end of your trading range (USD 150-175), it can provide buying options.

- breakout trade : Traders can use BSV support levels to start buying orders when the price exceeds $ 200 or resistance level for $ 250.

- Ichimoku Cloud : Ichimoku Cloud is a popular technical indicator that provides a valuable insight into BSV trends, support and resistance levels. The Bullish Ichimoki cloud may indicate a strong buying pulse.

Example of trade plan

Here is an example of using BSV price operating strategies:

Assuming the price is USD 175, with the bullish trend indicated by the 50 period MA and RSI, we can start a purchase order when the price exceeds this level. We are also considering using range trade or average reverse strategies to take advantage of buying options.

Conclusion

Pricing strategies offer a unique potential for Bitcoin SV (BSV) and its growth potential. Understanding technical features such as trends, support and resistance, traders can create effective trade plans that maximize their return. Remember to always trade with caution and consider several strategies before any trade start.

Trade Tips

- Always use the right risk management methods.

- Continuously monitor your transactions and adjust your strategy as market conditions change.

- Be aware of the latest news and events in the cryptocurrency space.

- Consider using technical analysis tools such as charts, indicators and other visual aids to help you make conscious trade decisions.

Добавить комментарий