Managing the risk of exchange rate in encryption negotiation

The number of cryptographic currency trade is to know the high volatility and the rapid fluctuations of the awards. As arid, investors have a significant loss of high risk of exchange rates. In this article, we will explore them with exchange risks and management guidelines is in the encryption trade.

What is exchange rate risk?

Exchange Risk Refers to the potential loss that the investor can cause you to change cryptocracy investors. This can occupy cryptocracy participation are converted into different currencies, resulting in loose gymnins or bases in floating exchange rates.

**To

There are several types of exchange rate risk that investors in the need to consider:

- If you have investor profiles or losses, it can be affected.

- FUTURE CONTRACT : FUNES is similar to a term contractive contract, but specifies specific date data.

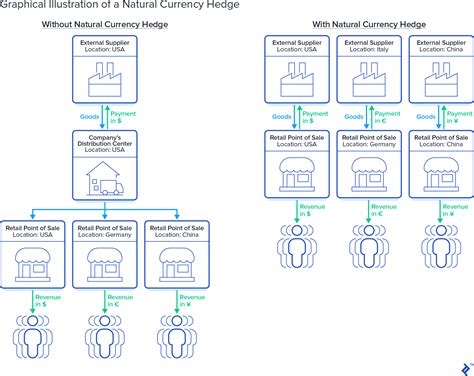

- Currency Hedging : Currency hedging involved surgery (eg options or strikers) to protect against loose potential due to exchange rates.

How to manage exchange rate risk in encryption negotiation

To manage the exchange rate risk in encryption negotiation, investors may consider the following strategy:

- Diversification : Playing investment in different cryptocurrency and active classes may be resting exposure to a specific currency.

- Hedging : Using derivatives (for example, options or future) has been used against possible loose exchange rates.

- Leverage Management : Margin births can amplify potential ginins, but they are all tastes of having a meaning.

- Position Dimensioning : The management of your positions is CRMICAL in the encryption trade. A great positioning can be difficult to shock and can lead to changes in the loose market chat.

5.

Best practices to manage exchange rate risk

Effectively manage exchange rate risks in encryption negotiation:

- Complete research conduct

: Before entering any trade or investing in cryptographic currency, it directly studies the marker, underlying technology and the risk of energy.

2.

- Use multiplied strategies : Combine differentiated hedge strategies (eg, options and future) and leverage octachnic management (eg positioning) to minimize flow rates in flow.

- Assists market conditions

: Continuously monitor cryptocurrency for marquet and adjust your strategy as needed.

- ** Stay informed.

Conclusion

Managing the risk of exchange is a crucial aspect of cryptographic commercial success. By conceptual risk of risk, implementing hedge strategies of effectiveness and remaining informed market contracts, investors can observe potential loss and maximize return marks.

Remember that no investment strategy ensures success, but following best practices and risks, you can rest your more trained decisions rate.

Добавить комментарий